All About Tulsa Debt Relief Attorney

What Does Chapter 7 - Bankruptcy Basics Do?

Table of ContentsSome Known Incorrect Statements About Top-rated Bankruptcy Attorney Tulsa Ok Excitement About Chapter 7 Vs Chapter 13 BankruptcyFacts About Bankruptcy Law Firm Tulsa Ok UncoveredThe Only Guide to Chapter 7 - Bankruptcy BasicsIndicators on Chapter 7 Vs Chapter 13 Bankruptcy You Need To Know5 Easy Facts About Chapter 7 Vs Chapter 13 Bankruptcy Described

People must make use of Phase 11 when their debts exceed Phase 13 financial debt limitations. It rarely makes good sense in various other circumstances however has a lot more alternatives for lien stripping and cramdowns on unsafe portions of guaranteed finances. Chapter 12 bankruptcy is created for farmers and fishermen. Chapter 12 payment plans can be a lot more adaptable in Chapter 13.The methods examination considers your ordinary regular monthly income for the six months preceding your filing date and compares it versus the typical revenue for a similar house in your state. If your income is listed below the state average, you automatically pass and do not have to finish the entire kind.

If you are married, you can submit for insolvency collectively with your spouse or independently.

Filing bankruptcy can help an individual by disposing of financial debt or making a plan to pay off debts. An insolvency instance typically begins when the borrower submits an application with the personal bankruptcy court. A request might be filed by an individual, by partners with each other, or by a corporation or various other entity. All personal bankruptcy cases are taken care of in government courts under guidelines detailed in the U.S

Tulsa Bankruptcy Attorney for Dummies

There are various kinds of insolvencies, which are usually described by their chapter in the united state Insolvency Code. Individuals might submit Phase 7 or Phase 13 insolvency, depending on the specifics of their scenario. Municipalitiescities, towns, villages, taxing districts, community energies, and institution areas may submit under Phase 9 to restructure.

If you are encountering economic obstacles in your individual life or in your company, chances are the concept of filing insolvency has crossed your mind. If it has, it likewise makes sense that you have a lot of bankruptcy questions that need solutions. Lots of people actually can not respond to the inquiry "what is bankruptcy" in anything except general terms.

If you are encountering economic obstacles in your individual life or in your company, chances are the concept of filing insolvency has crossed your mind. If it has, it likewise makes sense that you have a lot of bankruptcy questions that need solutions. Lots of people actually can not respond to the inquiry "what is bankruptcy" in anything except general terms.Lots of individuals do not understand that there are numerous types of insolvency, such as Phase 7, Chapter 11 and Chapter 13. Each has its advantages and challenges, so understanding which is the most effective alternative for your present situation in addition to your future recovery can make all the difference in your life.

A Biased View of Chapter 7 - Bankruptcy Basics

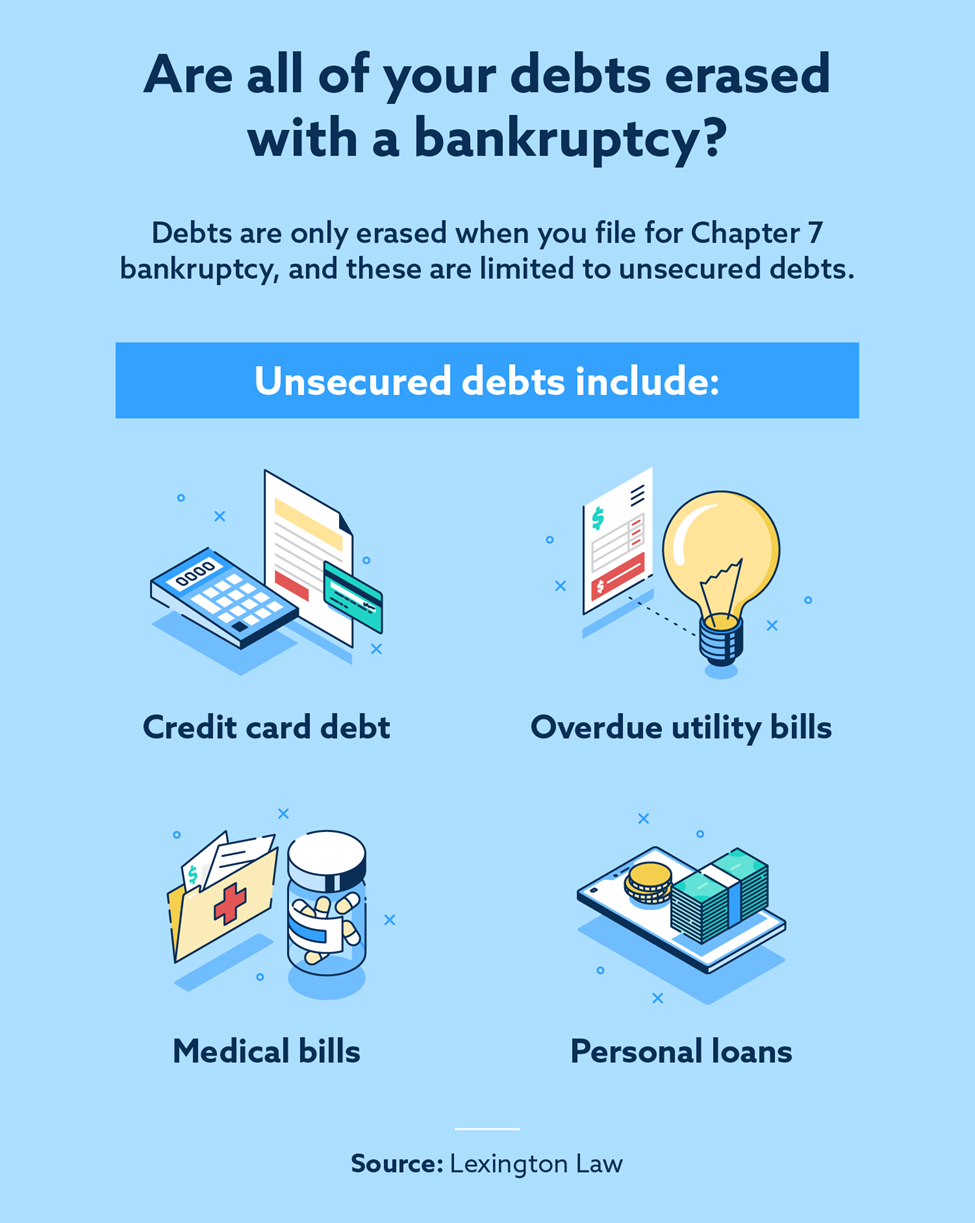

Chapter 7 is described the liquidation bankruptcy chapter. In a chapter 7 personal bankruptcy you can get rid of, clean out or discharge most types of financial debt.

Numerous Phase 7 filers do not have a lot in the way of possessions. Others have residences that do not have much equity or are in serious requirement of repair.

The quantity paid and the duration of the plan relies on the borrower's property, median income and costs. Lenders are not enabled to seek or maintain any type of go to this site collection tasks or claims throughout the instance. If successful, these creditors will certainly be wiped out or discharged. A Chapter 13 personal bankruptcy is really effective since it supplies a mechanism for debtors to prevent repossessions and sheriff sales and stop foreclosures and energy shutoffs while capturing up on their secured financial debt.

The Buzz on Affordable Bankruptcy Lawyer Tulsa

A Chapter 13 instance might be helpful in that the borrower is permitted to get caught up on home mortgages or auto loan without the risk of repossession or foreclosure and is allowed to maintain both exempt and nonexempt home. The borrower's plan is a paper laying out to the bankruptcy court how the debtor suggests to pay existing costs while settling all the old financial debt equilibriums.

It provides the borrower the chance to either offer the home or become captured up on mortgage payments that have dropped behind. A person submitting a Chapter 13 can recommend a 60-month plan to cure or become present on mortgage repayments. For circumstances, if you fell back on $60,000 well you can check here worth of home mortgage settlements, you could recommend a plan of $1,000 a month for 60 months to bring those home loan repayments existing.

It provides the borrower the chance to either offer the home or become captured up on mortgage payments that have dropped behind. A person submitting a Chapter 13 can recommend a 60-month plan to cure or become present on mortgage repayments. For circumstances, if you fell back on $60,000 well you can check here worth of home mortgage settlements, you could recommend a plan of $1,000 a month for 60 months to bring those home loan repayments existing.How Tulsa Ok Bankruptcy Specialist can Save You Time, Stress, and Money.

Often it is much better to avoid bankruptcy and work out with financial institutions out of court. New Jersey additionally has an alternative to bankruptcy for services called an Task for the Benefit of Creditors and our law company will certainly discuss this choice if it fits as a prospective approach for your company.

We have created a tool that assists you select what chapter your file is most likely to be submitted under. Click below to make use of ScuraSmart and discover a feasible remedy for your debt. Several people do not understand that there are numerous sorts of insolvency, such as Chapter 7, Chapter 11 and Chapter 13.

Right here at Scura, Wigfield, Heyer, Stevens & Cammarota, LLP we deal with all types of insolvency situations, so we have the ability to answer your insolvency concerns and assist you make the very best choice for your case. Here is a brief look at the financial debt relief alternatives readily available:.

See This Report on Top-rated Bankruptcy Attorney Tulsa Ok

You can only file for insolvency Before declaring for Phase 7, at the very least one of these must be true: You have a lot of financial obligation earnings and/or assets a financial institution could take. You have a lot of debt close to the homestead exception amount of in your home.

The homestead exemption amount is the greater of (a) $125,000; or (b) the county median price of a single-family home in the coming before fiscal year. is the amount of money you would certainly keep after you marketed your home and settled the mortgage and other liens. You can locate the.